Unlocking Opportunities: The Role of Forex Trading Companies in Today’s Market

Forex trading companies play a crucial role in today’s financial landscape, acting as intermediaries between individual traders and the vast global currency markets. By providing platforms, tools, and insights, these companies empower traders to navigate the complexities of forex trading effectively. Whether you are a novice trader eager to enter the market or an experienced investor looking for a reliable trading partner, forex trading company forex-vietnam.net serves as a valuable resource for understanding how to maximize your trading potential.

Understanding Forex Trading

The foreign exchange (forex) market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. Unlike stock markets, forex trading is conducted over the counter (OTC), meaning currencies are traded directly between parties, usually through electronic trading networks. This decentralized nature of forex trading provides numerous opportunities for traders but also comes with inherent challenges due to its volatility and the wealth of information available.

What Are Forex Trading Companies?

Forex trading companies are financial institutions or brokers that facilitate currency trading for individual and institutional traders. They provide essential services, including:

- Trading Platforms: Forex companies offer platforms that allow traders to execute trades, analyze markets, and manage their accounts. These platforms can vary in features and user interfaces, catering to different levels of trading experience.

- Leverage: Many forex brokers provide traders with leverage, enabling them to control larger positions than their actual capital would allow. While leverage can amplify profits, it also increases the potential for losses.

- Market Analysis: Forex trading companies often provide analysis and insights to help traders make informed decisions. This includes technical analysis, fundamental analysis, and economic indicators that influence currency movements.

- Customer Support: Strong customer support is crucial for traders, especially for those who may have questions or encounter issues while trading. Reliable forex companies offer various support channels, including live chat, phone support, and educational resources.

Choosing the Right Forex Trading Company

With numerous forex trading companies in the market, selecting the right broker is essential for your trading success. Here are some factors to consider:

1. Regulation

Ensure that the trading company is regulated by a reputable financial authority. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US enforce rules that protect traders’ interests. Trading with a regulated broker adds an extra layer of security to your investments.

2. Trading Costs

Review the broker’s trading costs, which may include spreads, commissions, or fees for different account types. Understand how these costs impact your overall profitability, particularly if you plan to execute high-frequency trades.

3. Available Currency Pairs

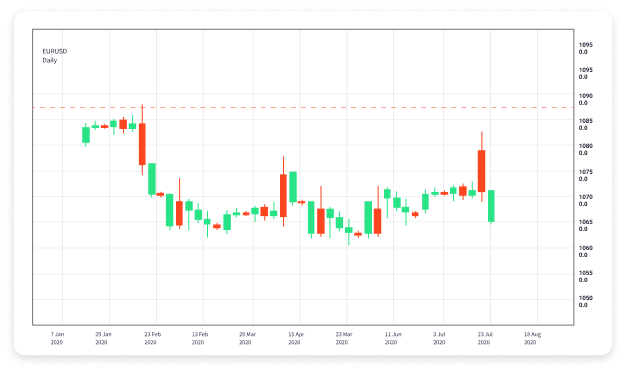

Check the currency pairs offered by the broker. Ensure they provide access to popular pairs like EUR/USD, GBP/USD, and USD/JPY, as well as cross currency pairs you may be interested in trading.

4. Trading Platforms and Tools

Examine the trading platforms and analytical tools offered by the broker. Look for features that suit your trading style, such as advanced charting capabilities, mobile trading options, and algorithmic trading support.

5. Customer Reviews and Reputation

Investigate the broker’s reputation through customer reviews and ratings. Feedback from other traders can provide valuable insights into the company’s reliability and the quality of its services.

The Future of Forex Trading

The forex market is continually evolving, driven by technological advancements and changing economic landscapes. Here are a few trends that may shape the future of forex trading:

1. Increasing Use of AI and Machine Learning

Artificial intelligence (AI) and machine learning technologies are making their way into forex trading. These technologies can analyze vast amounts of market data to identify trading opportunities and enhance decision-making.

2. Rise of Retail Trading

With the introduction of user-friendly trading platforms and educational resources, retail trading is on the rise. More individuals are participating in forex trading, diversifying the market with a larger pool of participants.

3. Regulatory Changes

As the forex market grows, regulatory scrutiny may increase. Traders should stay informed about potential regulatory changes that could impact their trading strategies or broker operations.

4. Global Economic Considerations

The forex market is profoundly influenced by global economic factors, including interest rates, employment reports, and geopolitical events. As economic interconnections deepen, traders must remain aware of how these factors can affect currency values.

Conclusion

Forex trading companies serve as essential partners for traders venturing into the dynamic world of currency trading. By providing necessary tools, resources, and support, these companies empower individuals and institutions to capitalize on opportunities within the forex market. As the trading landscape continues to evolve, understanding the role of forex brokers will be crucial for successfully navigating this complex and exciting field.

0 comentarios